Bookkeeping Services

B3 Financial bookkeeping services offer various options designed to meet your business needs, from simple record-keeping to complex financial analysis. Let us help you automate time-consuming and repetitive bookkeeping tasks so you can spend more time growing your business.

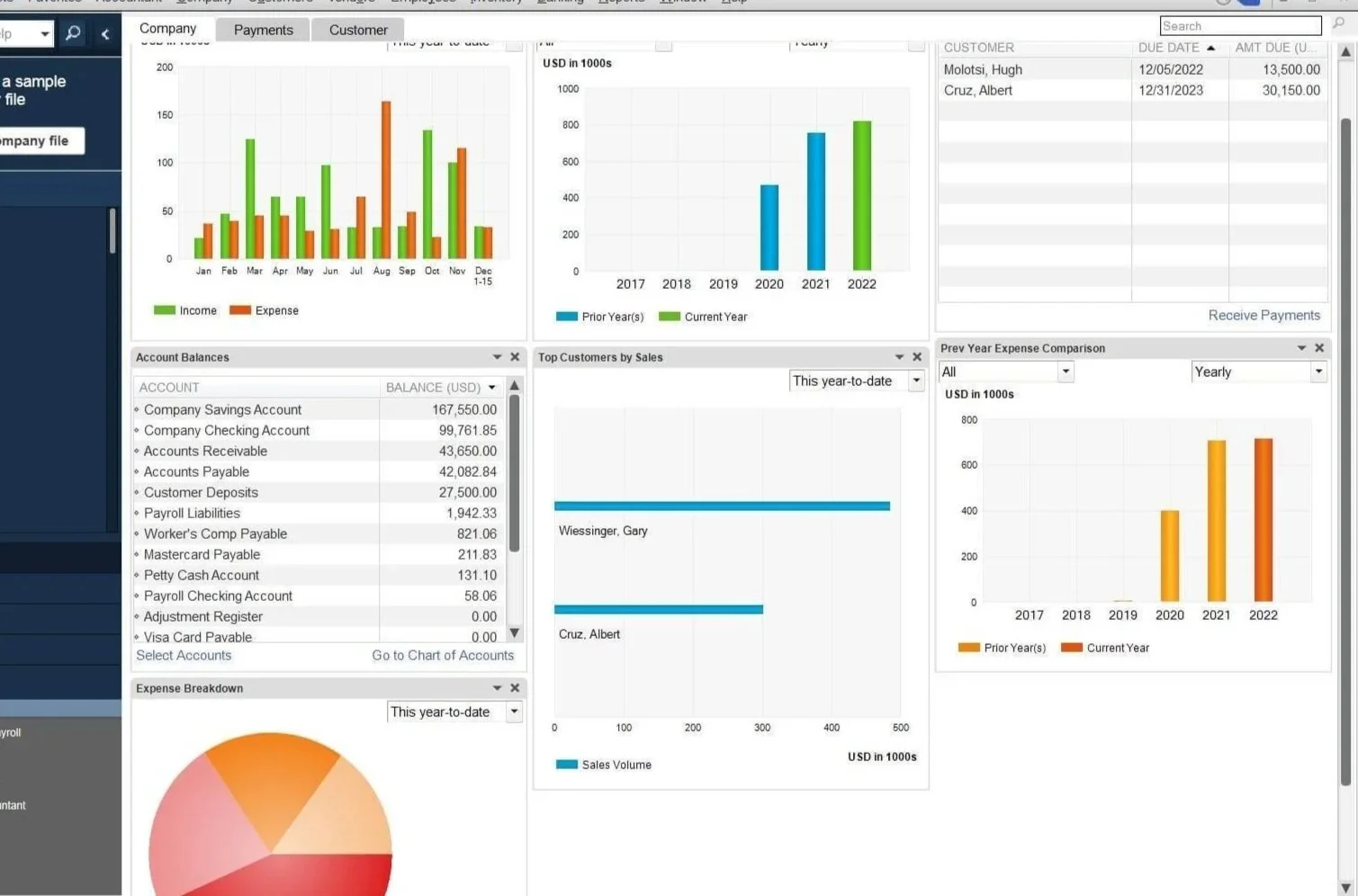

Bookkeeping involves a range of financial duties, from managing operational tasks like payroll and inventory to supporting strategic planning through budgeting and forecasting. These services are tiered to provide scalable solutions as a business grows, ensuring accurate and timely financial management.

Advanced

Advanced bookkeeping represents a significant evolution from essential services, transforming from simple transaction management into a high-level strategic function. This comprehensive oversight is less about day-to-day data entry and more about ensuring the integrity of complex financial systems to provide the actionable intelligence a large business needs to thrive.

Services Starting at $185/month

Here are explanations for each of those bookkeeping terms:

Track billable hours: This involves meticulously recording the time spent on specific projects or for individual clients. This process is essential for service-based businesses to accurately invoice clients and ensure all work performed is properly accounted for and paid.

Accounts Receivable (AR) Management: This is the process of managing the money owed to your business by clients or customers. It includes sending out invoices, following up on unpaid balances, and applying payments to the correct accounts. Proper AR management is vital for maintaining a healthy cash flow.

Accounts Payable (AP) Management: This is the opposite of AR, dealing with the money your business owes to suppliers and vendors. It involves receiving and entering bills, scheduling and making payments, and reconciling vendor statements. Efficient AP management helps avoid late fees and builds strong relationships with suppliers.

Payroll processing: This is the comprehensive management of paying employees. The task includes calculating wages, withholding taxes, managing deductions for benefits, and ensuring compliance with federal and state labor laws. This process also involves generating employee pay stubs and filing payroll tax reports.

Generate tax reports: This involves creating the necessary financial documents for filing taxes. These reports, such as a Profit and Loss statement and Balance Sheet, summarize a business's financial activity over a period, providing the data needed for accurate tax returns.

Adding On Services:

Connecting CRM apps: Streamline your business and sync your data.

Job costing: Tracking the costs and profitability of individual projects.

Custom financial analysis: Generating specialized reports to provide deeper business insights.

Inventory tracking: Monitoring stock levels and the cost of goods sold.

Budgeting and forecasting: Creating financial plans and predicting future performance.

Other