Bookkeeping Services

B3 Financial bookkeeping services offer various options designed to meet your business needs, from simple record-keeping to complex financial analysis. Let us help you automate time-consuming and repetitive bookkeeping tasks so you can spend more time growing your business.

Bookkeeping involves a range of financial duties, from managing operational tasks like payroll and inventory to supporting strategic planning through budgeting and forecasting. These services are tiered to provide scalable solutions as a business grows, ensuring accurate and timely financial management.

Basic

Basic bookkeeping is the foundational process of meticulously recording and organizing a business's daily financial transactions. This level of service ensures accuracy and provides a clear, up-to-date snapshot of a company's financial position, which is essential for both internal management and tax preparation.

Services Starting at $85/month

Here are explanations for each of those bookkeeping and accounting terms:

Track income & expenses: This is the core of bookkeeping, involving the systematic monitoring of all the money flowing into (income) and out of (expenses) a business. The goal is to see a clear, real-time picture of a company's financial performance.

Connect your bank: A feature in modern accounting software that securely links your business checking account. This allows for the automatic import of all your bank transactions, saving significant time and reducing manual data entry errors.

Connect your credit cards: Similar to a bank connection, this links your business credit cards to your accounting software. It automatically imports all credit card charges and payments, providing a complete record of your business spending.

Reconciling accounts: The process of cross-referencing and matching the transactions recorded in your accounting software with the official statement from your bank or credit card company. This is a critical step to ensure that your records are accurate and complete.

Categorizing expenses: The act of assigning each transaction to a specific financial category (e.g., marketing, office supplies, or travel). This provides a clear breakdown of where money is being spent and is crucial for generating accurate financial reports and preparing for tax season.

Recording transactions: The fundamental task of entering every single financial activity, such as sales, purchases, payments, and refunds, into the accounting system. While often automated through bank connections, this ensures a permanent, detailed record of all business finances.

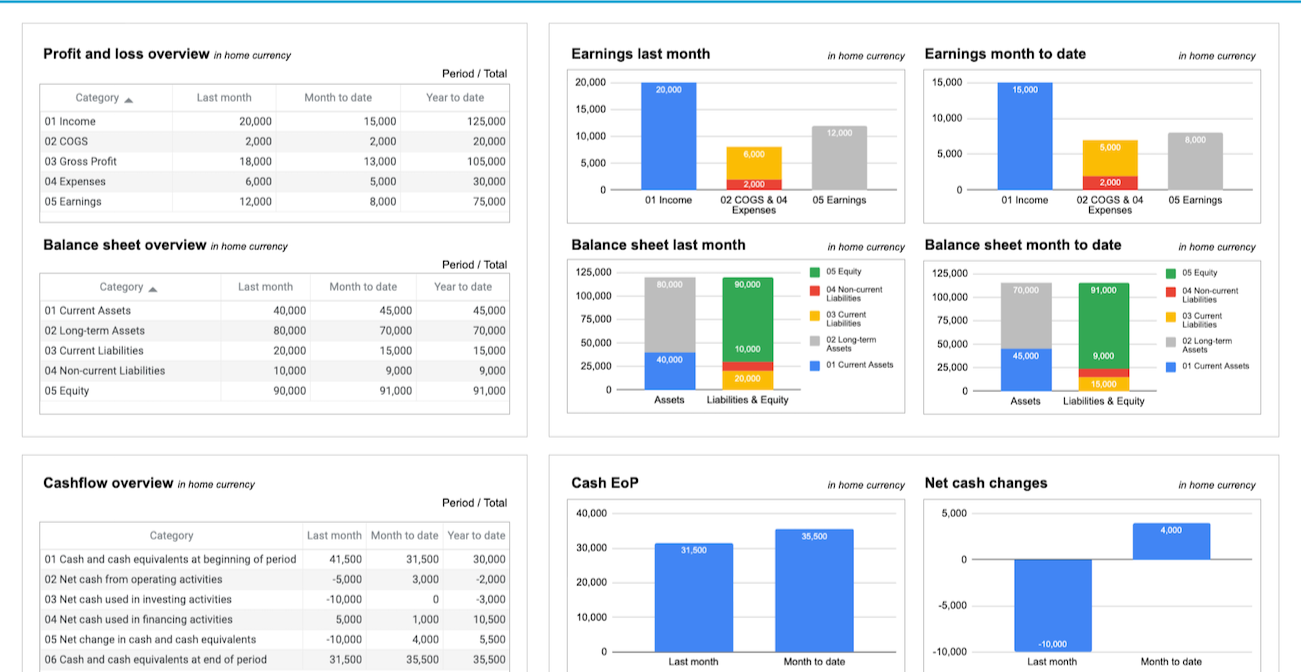

Monthly reports: Key financial documents generated at the end of each month that summarize your business's performance. The most common reports are the Profit and Loss Statement (showing revenue and expenses) and the Balance Sheet (showing assets, liabilities, and equity).

Monthly insights: A more in-depth analysis that goes beyond the basic numbers in a report. These insights highlight trends, spot opportunities, or identify potential problems in your business finances, giving you a better understanding of what the data means.